are combined federal campaign donations tax deductible

You can choose to make Donations through a payroll deduction or a one-time donation. Political contributions deductible status is a myth.

Tax Benefits Of Charitable Donations 2022 Turbotax Canada Tips

With almost 200 CFC campaigns throughout the country and overseas CFC is the worlds largest most successful annual workplace charity campaign and has raised over 7 billion for non-profits over the past 50 years.

. If a donor makes a CFC payroll deduction are those contributions taken pre-tax or after-tax. However the truth is that political donations are not tax-deductible. Employees typically make their donations to the CFC via payroll deduction in which they elect to have a certain dollar amount deducted from their paycheck and sent to the CFC.

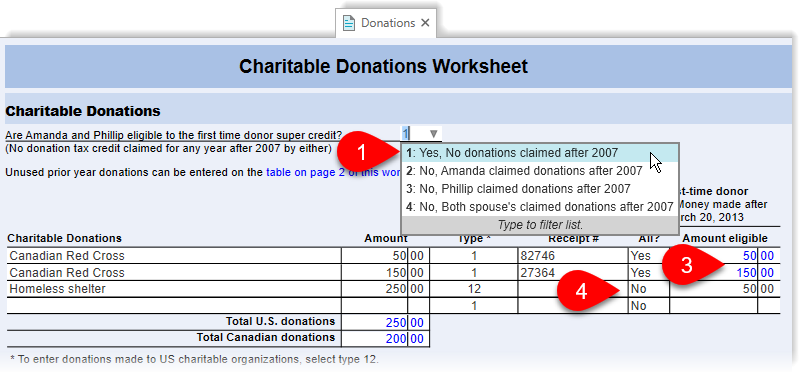

Since its inception the CFC has raised more than 85 billion for charities and people in need. While inside the software and working on your return type charitable donation in the Search at the top of the screen you may see a magnifying glass there. The answer is no donations to political candidates are not tax deductible on your personal or business tax return.

The Combined Federal Campaign CFC makes automatic deductions from your salary each pay period and sends your gift to your chosen organization or cause within the CFC donation list. All your contributions made through the CFC are tax-deductible. Individual donations to political campaigns.

Your tax deductible donations support thousands of worthy causes. The IRS is very clear that money contributed to a politician or political party cant be deducted from your taxes. Most of the time donors have big money and they qualify to be in a millionaire group at least.

For our supporters employed by the Federal Government the Fund is also registered in the Combined Federal Campaign as Diplomacy Matters-AFSA and its CFC number is 10646. To a state local or district party. Each of these zones has.

How to get to the area to enter your donations. Wrongfully claiming political contributions can and will attract the attention of the Internal Revenue Service and can lead to an assessment of additional taxes due penalties and interest. Combined Federal Campaign CFC Are you a federal employee or retiree.

The combined federal campaign makes automatic deductions from your salary each pay period and sends your gift to your chosen organization or cause. This year the CFC celebrates its 60th anniversary. Even so they are not exempted from taxes on political donations as per the US federal law.

All donations to the FAD are tax-deductible. The same goes for campaign contributions. 1 Combined Federal Campaign.

All contributions made through the CFC are tax-deductible. Through Combined Federal Campaign. The Combined Federal Campaign is a 58-year Federal workplace giving tradition that has raised more than 83 billion for charitable organizations.

Although political contributions are not tax-deductible there is always a limit to the amount that can be contributed to a political campaign. Federal law does not allow for charitable donations through payroll deduction CFC or any other. If youre planning to donate money time or effort to a political campaign you might be thinking to yourself Are political contributions tax-deductible No.

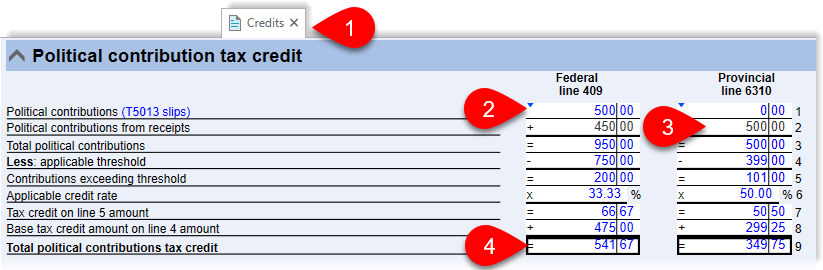

If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible. 10000 combined To a national party. Are combined federal campaign donations tax deductible.

Through the contributions of civilian and military federal. Thank you for contributing through the Combined Federal Campaign CFC. The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to receive tax-deductible donations.

We appreciate your support. There will be a. Area and whose net pay is sufficient to cover the allotment may authorize payroll deductions for.

If you decide to make a donation can you get a tax deduction. Overseen by the Office of Personnel Management OPM the Combined Federal Campaign is the official workplace giving campaign for federal employees and retirees. Chesapeake Care Clinic is a 501c3 nonprofit organization and donations are tax deductible.

A charitable contribution is the authorization by an employee to withhold through payroll deductions contributions for the Combined Federal Campaign CFC. It doesnt matter if it is an individual business or other organization making the donation the campaign contribution is not deductible. Individuals can contribute up to 2800 per election to the campaign committee up to 5000 per year for PAC and up to 10000 per year for local or district.

You may make a donation directly to the FAD by clicking here. Any employee whose duty station is located within an approved CFC. Federal law does not allow for charitable donations through payroll deduction CFC or any other payroll deduction program to be done pre-tax.

The CFC is comprised of 30 zones throughout the United States and overseas. However the IRS does not allow contributions to any politician or. In any case you have to pay taxes on your political donations.

This year the CFC celebrates its 60th anniversary. Can I deduct my contributions to the Combined Federal Campaign CFC. This doesnt just mean that donations made to candidates and campaigns are excluded from being tax deductible.

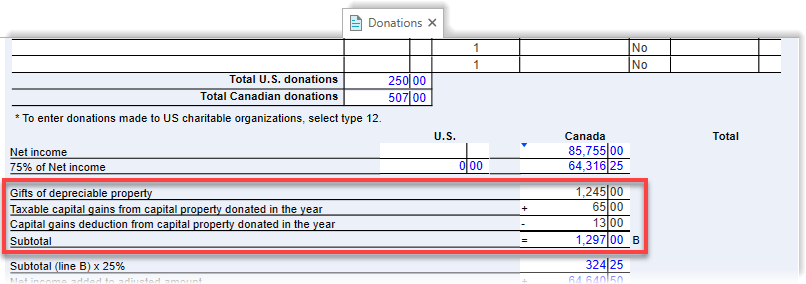

You cannot deduct contributions made to a political candidate a. Donors who are eligible to itemize charitable contributions on income tax returns may include contributions made through the CFC. The funds raised each fall through the campaign help neighbors in need around the corner across the nation and throughout the world.

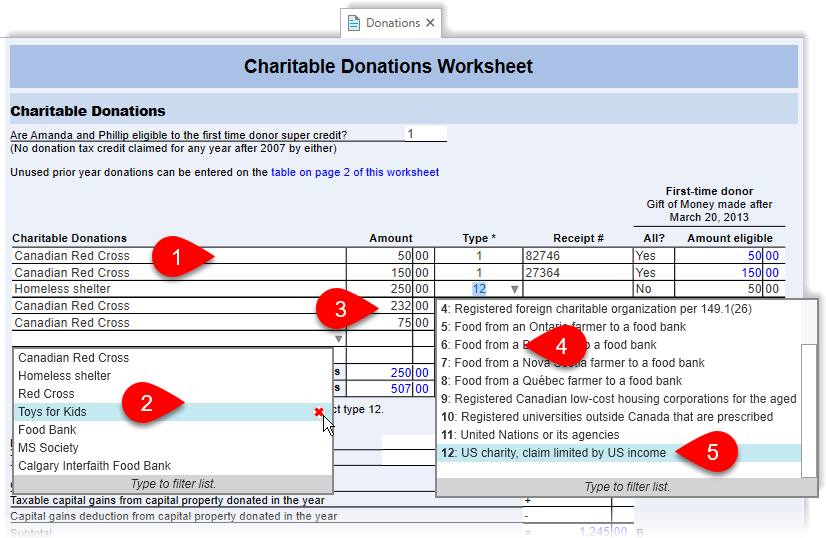

Yes you can deduct them as a Charitable Donation if you file Schedule A. For federal employees one organization that qualifies as a cashcheck charitable donation is the Combined Federal Campaign CFC. Donors should contact a tax advisor for more information.

And since all participating recipients are 501c3 organizations you will enjoy a combined federal campaign tax deduction. Donors should contact a tax advisor for more information. Donate to the north korea freedom coalition.

Donations are tax deductible to the extent provided by law. Many believe this rumor to be true but contrary to popular belief the answer is no. That is the question on many Americans minds this election year.

Combined Federal Campaign Foundation Inc. Political Contributions Are Tax Deductible Like. While tax deductible CFC deductions are not pre-tax.

According to the Internal Service Review IRS The IRS Publication 529 states. FY 2021 990 FY 2021 Audited Financial.

13 Tips For Making Your Charitable Donation Tax Deductible In 2017

Tax Deductible Donations These Are The Conditions

Tax Deductible Donations Can You Write Off Charitable Donations

How The 3 Campaign Contribution Check Box On Your Tax Form Works Marketplace

Tax Benefits Of Charitable Donations 2022 Turbotax Canada Tips

Combined Federal Campaign Wikipedia

Donate To Psc Partners Help Find A Cure For Primary Sclerosing Cholangitis Psc Partners Seeking A Cure

Charitable Deductions On Your Tax Return Cash And Gifts

How To Make Crypto And Nft Donations To Nonprofits Vault12

Tax Deductible Donations Can You Write Off Charitable Donations

Donation Tax Credit How It Works For Personal Tax And Corporate Tax

How Much Should You Donate To Charity District Capital

What Is The Combined Federal Campaign Article The United States Army

Nonprofit Tax Programs Around The World Eu Uk Us

How Did The Tcja Affect Incentives For Charitable Giving Tax Policy Center